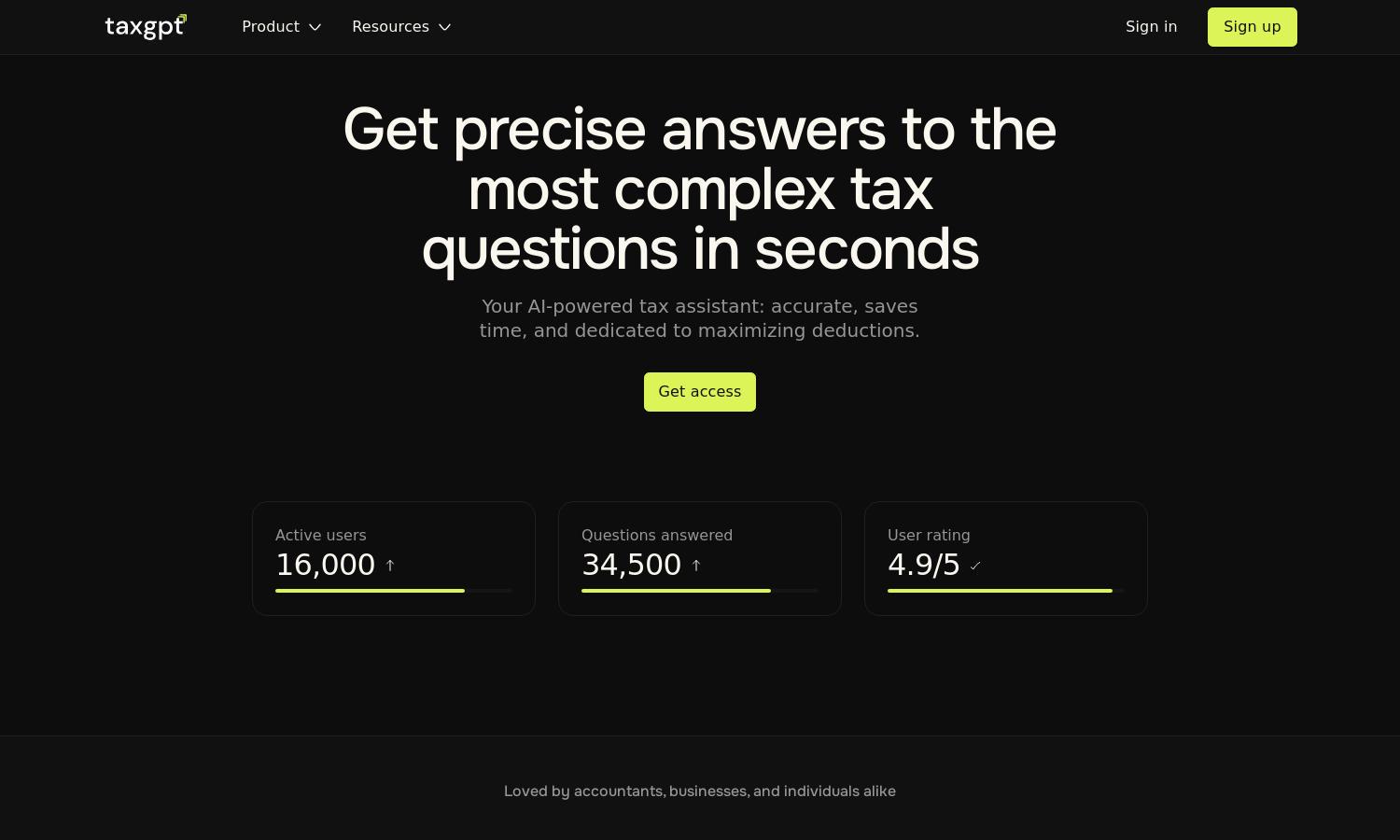

TaxGPT

About TaxGPT

TaxGPT is a state-of-the-art AI-powered tax assistant that revolutionizes how tax professionals and accountants operate. By providing accurate answers and simplifying tax research and memo writing, it saves users time and enhances productivity, ultimately helping firms to serve clients more efficiently.

TaxGPT offers flexible pricing plans, including a free 14-day trial for new users to experience its features. Subsequent subscription tiers provide enhanced functionalities and special perks, ensuring that all users get maximum value from their investment in their AI tax assistant.

The user interface of TaxGPT is designed for optimal navigation, providing a seamless experience for tax professionals. Its intuitive layout and user-friendly features make it easy to access vital tools and functionalities, ensuring that users can quickly and efficiently respond to clients' needs.

How TaxGPT works

Users start with an easy onboarding process at TaxGPT, signing up swiftly to access their personalized dashboard. From there, they can engage with the AI tax assistant to get instant answers to complex tax queries or utilize memo-writing features. Intuitive navigation guides users through essential functionalities, streamlining their workflow and enhancing efficiency effectively.

Key Features for TaxGPT

AI-Powered Tax Co-Pilot

The AI-Powered Tax Co-Pilot feature of TaxGPT dramatically enhances productivity for tax professionals. By automating complex tasks like research and memo writing, it empowers users to deliver accurate, timely responses to clients, ultimately saving valuable time and boosting their service capabilities.

Seamless Client Integration

TaxGPT's seamless client integration allows firms to embed the AI assistant smoothly onto their websites. This functionality enhances client interactions, providing intuitive chat support while simplifying document management, ensuring a more efficient workflow and superior client experience.

Maximized Deductions Feature

The Maximized Deductions feature in TaxGPT helps identify eligible tax deductions ensuring clients optimize their tax savings. This innovative function not only reduces the risk of overpaying taxes but also assists tax professionals in maximizing their clients' financial outcomes.

You may also like: