Addy AI

About Addy AI

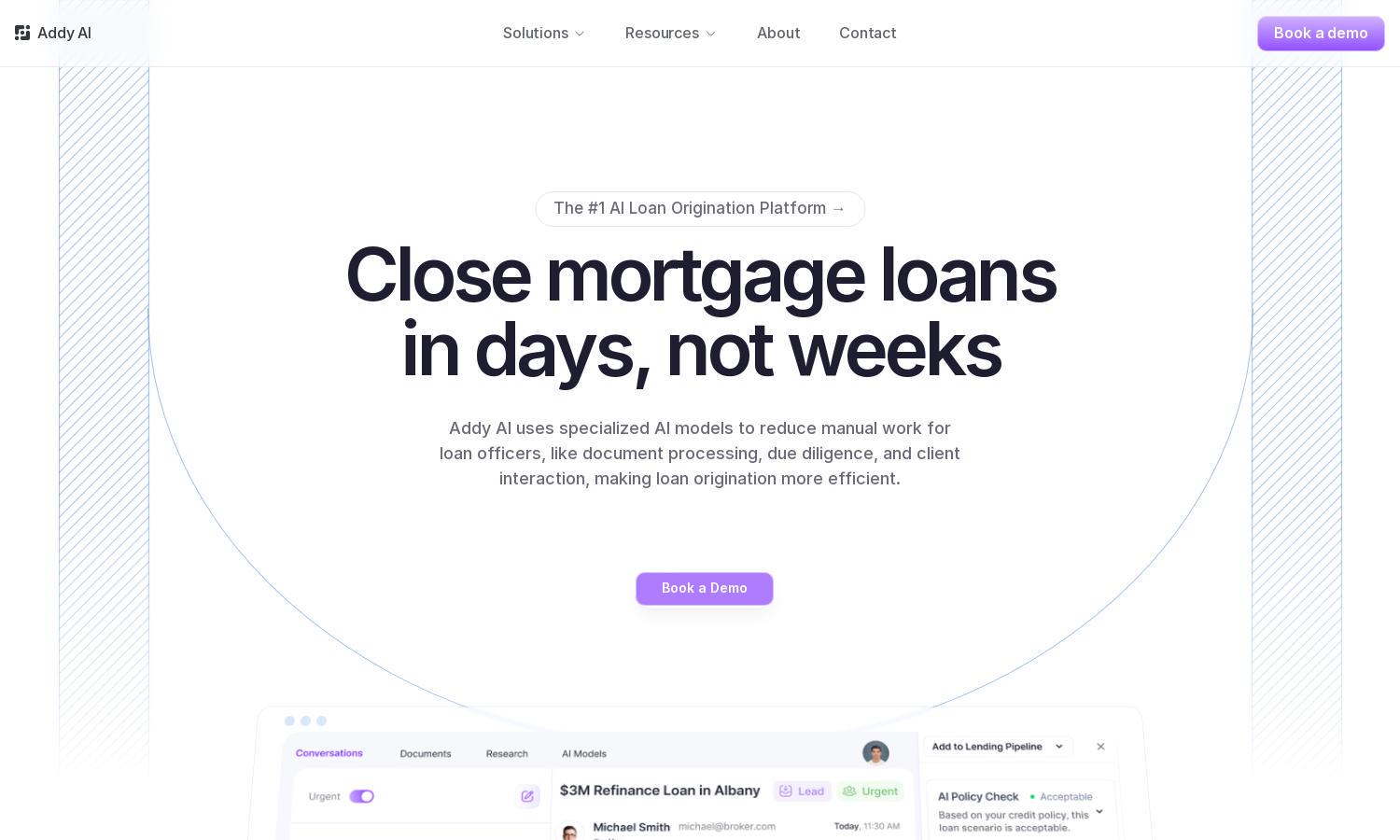

Addy AI offers mortgage lenders an innovative platform that automates the loan origination process using customized AI models. By reducing manual tasks like document processing and client interactions, Addy AI enables lenders to close loans dramatically faster. Users benefit from increased efficiency and enhanced client satisfaction.

Addy AI provides a flexible pricing model to accommodate lenders of various sizes. Each subscription tier offers features like custom AI training and CRM integration. Upgrading unlocks advanced functionalities, allowing users to maximize efficiency and improve loan processing times, enhancing competitiveness in the lending market.

The user interface of Addy AI is designed for maximum efficiency, with intuitive navigation and powerful integration options. Its user-friendly layout ensures a seamless experience, while unique features like natural language document processing enhance usability. This makes Addy AI a top choice for modern mortgage lenders.

How Addy AI works

Users begin their journey with Addy AI by creating an account and integrating their existing CRM and loan origination systems. The platform guides them through training custom AI models tailored to their specific needs, focusing on automating tasks like document processing and client follow-ups. As users interact with the platform, they can easily access insights, train their AI assistants, and track loan assessments, maximizing workflow efficiency and achieving rapid loan closures.

Key Features for Addy AI

AI-Powered Document Processing

Addy AI's AI-Powered Document Processing feature enables lenders to extract relevant information from large documents instantaneously. By utilizing advanced computer vision and natural language processing, this functionality elevates efficiency, ensuring lenders access essential loan data quickly and accurately, significantly enhancing the loan origination process.

Seamless CRM Integration

With Addy AI's Seamless CRM Integration, mortgage lenders can effortlessly sync their loan data with existing systems. This capability streamlines workflows and reduces context-switching, allowing loan officers to focus more on client interactions and less on administrative tasks, thereby enhancing overall productivity and service quality.

24/7 Client Follow-Ups

Addy AI’s 24/7 Client Follow-Ups feature automates borrower interactions, responding to inquiries and facilitating communication around the clock. By ensuring timely follow-ups, this functionality enhances client satisfaction and fosters a smooth lending experience, helping lenders stand out in a competitive market.

You may also like: